With the rising demand for fast and accessible financial services—especially in under-banked, sub-urban and rural areas—starting a POS business has become one of the most successful small business ideas in Nigeria. However, in today’s Nigerian economy, the “wild west” era of the POS business is over. For years, anyone could pick up a POS terminal, print a banner, and start collecting cash. That era is ending.

Regulators have now moved from encouragement to enforcement. The Corporate Affairs Commission (CAC), working with financial regulators like the Central Bank of Nigeria (CBN), is actively pushing for full registration and traceability of every POS operator in Nigeria.

This guide connects directly with our Ultimate Guide to Registering and Starting a Business in Nigeria, because the first step to a successful POS business is no longer getting a machine — it is getting your legal shield (CAC registration). Without it, you are building on quicksand.

Free Business Launch Toolkit (2026 Edition)

To help you survive the new enforcement mandates, we about to release the best Nigeria-Specific Business Plan & Feasibility Toolkit. It includes a ready-to-use POS business plan for bank loans and an automated “Float Manager” spreadsheet to help you track daily profits and commission margins accurately.

The POS (Point of Sale) business, also known as Agency Banking, remains one of the most reliable ways to generate daily cash flow in Nigeria. But with over two million agents nationwide, the market now rewards compliance, structure, and location strategy, not just “owning a machine.”

Regulatory Reality: Register or Risk Shutdown

Regulators now require every serious POS operator to be registered as a business entity. Under the January 1, 2026 enforcement mandate, any terminal not linked to a registered CAC Business Name or Company is liable to be shut down.

Why this matters:

- Fraud Prevention: Law enforcement now uses CAC records to trace fraudulent “reversal” scams back to the terminal owner.

Transaction Traceability: Every kobo must be accounted for under a legal business profile. - Consumer Protection: Customers are increasingly wary of “umbrella” agents; they look for registered signage to feel safe.

Access to Loans: In 2026, you cannot access SME intervention funds or “overdraft” facilities from fintechs without a verified TIN and CAC certificate.

Before approaching a bank or fintech for a POS terminal, you should complete your Business Name registration. - Action: Follow the steps in our Ultimate Guide to Registering and Starting a Business in Nigeria to get your CAC certificate and TIN ready before applying for any POS machine.

The risk of ignoring this: - Unregistered operators face terminal withdrawal, service suspension, and loss of access to major fintech platforms during mandatory compliance checks

Exclusivity & Geo-Fencing Rules (What Every POS Founder Must Know)

The POS business is no longer “plug and play.” Regulators have introduced two operational controls that now shape how every serious agent must operate:

- The Exclusivity Rule: One Principal, One Business

As of April 1, 2026, an agent can only operate under one financial institution (called a Principal) at a time.

This means:

- You cannot run OPay today and Moniepoint tomorrow on the same business.

- You must formally choose your partner bank or fintech.

- Your CAC registration, TIN, and business address are tied to that single provider’s network.

Why this matters:

Your choice of partner now affects your fees, support, uptime, and access to loans. Since you can’t “switch” during a network failure without terminating your existing contract, you must choose a partner with the highest reliability rating in your specific area.

- Geo-Fencing: Your Terminal Is Locked to Your Business Address

Every terminal deployed in 2026 is equipped with a mandatory Geolocation SDK. Your POS terminal is digitally locked to your registered business location within a strict 10-metre radius.

Why this matters:

- No More “Roaming”: The address you submitted during onboarding becomes your Approved Address.

- Automatic Shutdown: If the terminal is moved outside that 10-metre zone, the system will automatically restrict transactions or shut down the device.

- Location Planning: You must choose your shop location carefully before onboarding. Moving later is no longer simple—it requires formal approval from your Principal and physical re-verification of the new site.

The ₦1.2 Million Daily Cap & Compliance

In addition to where you operate, the rules also govern how much you can move.

- Agent Daily Cash-out Limit: ₦1.2 Million.

- Individual Customer Limit: ₦100,000 daily at a POS point.

These caps are designed to improve traceability and curb the use of POS terminals for large-scale illicit fund movements. For a founder, this means if your location is high-traffic, you may need to register multiple distinct Business Names to manage higher volumes legally.

Summary: Compliance is Your Competitive Edge

Currently, being “legal” is your biggest advantage. While unregistered agents are being shut down and geo-fenced out of the market, registered founders who follow these rules will have access to the ₦10.5 Trillion agency banking market with full protection from the law.

Choosing the Best POS Partner: OPay vs. Moniepoint vs. Banks (Founders’ Comparison)

Choosing the right partner is the most critical decision for your POS business. Because of the Exclusivity Rules we discussed earlier, you can no longer “try three machines and see what works.” You must commit to one principal who will handle your settlements, your KYC, and your future access to loans.

Traditional banks are making a comeback because regulatory reforms have pushed them to compete seriously for SME customers, but fintechs like OPay and Moniepoint still lead in speed, onboarding, and founder support. In today’s market, the real competition is no longer about who is cheapest. It is about uptime, support, and growth potential.

- The Golden Rule: A terminal that is ₦20 cheaper but fails 10% of the time will quietly destroy your business reputation.

- Head-to-Head Comparison Table

| Feature | Moniepoint | OPay | Traditional Banks |

| Uptime Reliability | 99.8% (Industry Peak) | 98.7% (Very Reliable) | 95.5% (Recapitalization Era) |

| Withdrawal Fee | 0.5% (Max ₦100) | 0.5% (Max ₦100) | 0.5% (Max ₦150) |

| Transfer Fee | ₦20 Flat | ₦10 – ₦50 (Tiered) | ₦0 – ₦25 (SME Packages) |

| Loan Access | Instant “Working Capital” | Daily-Target “Quick” Loans | Low-interest Gov. Loans |

| Ownership | Lease/Caution Fee (₦22,500) | Purchase/Lease (From ₦8,500) | Outright Purchase (₦65k – ₦85k) |

- Deep Dive: Which One Fits Your Goal?

Moniepoint – The Business Builder: Best for founders who want to use their POS history to grow into a bigger business. They offer automated working-capital loans and a robust business banking app.

- Edge: Best physical support; they have “Business Relationship Managers” in almost every local government.

Downside: High pressure; stay dormant for too long and your machine may be retrieved.

OPay – The Consumer King: Best for high-traffic retail areas and agents with limited starting capital.

- Edge: Fastest “off-us” transfers and the lowest entry cost for their “Mini-POS” hardware.

- Downside: Support is 90% digital/in-app; hardware issues can take days to resolve.

Traditional Banks – The Stability Giants: Best for long-term expansion and established retail outlets.

- Edge: Using a bank POS (like FirstMonie or Zenith) builds a “heavy” credit history that qualifies you for 9% interest Bank of Industry (BOI) loans.

- Downside: Slower onboarding; they require physical verification of your CAC Status Report before issuance.

- Hidden Costs & Limits to Watch Out For

EMTL (Electronic Money Transfer Levy): A flat ₦50 fee is now deducted for all electronic receipts of ₦10,000 and above (FIRS Requirement).

- Agent Daily Cap: Remember, as an agent, you are capped at ₦1.2 Million in daily cash-out transactions to prevent money laundering.

VAT on Fees: Note that the 7.5% VAT is charged on the fee(e.g., 7.5% of ₦100), not the transaction amount.

Final Verdict: Match the Partner to Your Vision

- Choose Moniepoint if you want fast growth and instant business loans.

- Choose OPay if you want speed, low entry cost, and a sleek app.

- Choose a Bank if you are building a large, long-term enterprise and need government-backed funding.

Still want help deciding on POS machine to get for your business? Check out our guide on best Fintech POS machines in Nigeria. We can assist you develop a winning POS business plan — tailored to attract investors. Contact us today — let’s bring your business idea to life or try our Nigeria-Specific Business Plan & Feasibility Toolkit

Finding the Perfect Location for Your POS Business

In a regulated POS environment, with geo-fencing, exclusivity rules, and tighter central bank monitoring, location is no longer something you “manage later.”

It is your most important strategic decision after choosing your POS partner. If you get this wrong, even top providers like Moniepoint or OPay cannot save the business.

Why Location Matters

A POS terminal’s success depends on foot traffic, cash flow, visibility, and security. Even a top-performing terminal will underperform if placed in a low-traffic or hard-to-access area.

- Foot Traffic: Choose spots where people naturally gather, like markets, bus stops, or busy retail streets.

- Cash Dependency: Areas with high cash transactions increase POS usage frequency.

- Security: Ensure your terminal is in a secure, visible location to reduce theft and fraud risk.

- Competition & Saturation: Avoid clustering near other terminals from the same network. Oversaturation reduces your daily transactions.

POS business Location Strategic Checklist

Before you commit to a location:

- Accessibility: Customers should reach you easily; consider proximity to public transport.

- Visibility: A terminal in plain sight encourages spontaneous use.

- Operational Hours: Ensure your spot is active during peak hours for your target audience.

- Connectivity: Check mobile network strength if your terminal relies on 4G/5G.

- Compliance Test: Confirm your location aligns with your POS provider’s geo-fencing requirements.

- Optional: Scoring Your Potential Locations

Assign 1–5 points for each factor (traffic, cash volume, security, visibility, network strength) for 3–5 candidate locations. Total the scores to identify the most profitable and compliant spot.

Smart founders treat location as their first strategic asset. The right choice ensures consistent transaction volume, protects your investment, and positions your POS for loan eligibility and growth

| Factor | Spot A (Market) | Spot B (Estate Gate) | Spot C (Bus Park) |

| Foot Traffic | |||

| Cash Demand | |||

| Security | |||

| Network Signal | |||

| TOTAL SCORE |

- Founder Strategy: Smart founders treat location as their first strategic asset. The right choice ensures consistent transaction volume, protects your investment from regulatory shutdowns, and positions your POS for loan eligibility and growth.

How to Get Approved for a POS Machine in 48 Hours (2026)

Once you’ve chosen your POS partner and secured the right location, the next move is speed. In today’s regulated POS environment, approval is no longer about “knowing a marketer.” It is about compliance, data accuracy, and operational readiness.

Following the steps on registering and Starting a Business in Nigeria ensures you have the legal “keys” needed to unlock this speed. Here is the exact, no-fluff process to get your POS machine approved and activated within 48 hours.

Step 1: Prepare Your Compliance Bundle

Most approvals fail because founders start the application without the right documents. In 2026, the FIRS, CAC, and CBN databases are integrated—any mismatch will trigger an automatic “Red Flag.”

Have these ready in clear digital format (PDF or JPG):

- CAC Certificate & Status Report: (Business Name or Limited Company).

- Active Tax ID (TIN): Now linked to your RC/BN number via the NTAA 2025 reforms.

- Director’s BVN & NIN: These must be linked and verified via the NIMC-BVN portal.

- Utility Bill: Showing the exact business address for geo-fencing setup.

- Business Photo: A photo of your shop or kiosk (meeting the “fixed structure” requirement).

Step 2: Apply Through the Right Channel

Choose one principal only. Due to the 2026 Exclusivity Rule, your application will be rejected if you have an active contract with another provider.

Fintechs (Moniepoint, OPay, PalmPay): Apply via their official mobile app. You will fill a form and upload your documents directly.

- Traditional Banks: Visit a branch. In 2026, banks like First Bank and Access use a “POS Merchant Business” email for fast-track processing.

Step 3: Complete the KYC & Geo-Fencing Check

Within 24 hours, the provider’s automated system or a relationship manager will conduct a verification:

- Identity Check: A “Liveness” selfie or short video to match your NIN record.

- Location Verification: In 2026, this is powered by GPS tagging. You must be at your shop when you submit the final part of the application. The system will “lock” the terminal to those coordinates (the 10-Metre Rule).

- Credit Check: The system verifies that you have no non-performing loans within the last 12 months.

Step 4: Approval & Machine Deployment

Once verified, the process moves quickly:

- Digital Banks: Your POS account is activated immediately. You can pick up the terminal at a local “Business Hub” or have it shipped to your 10-metre geo-fenced location within 24 hours.

- Traditional Banks: Approval takes 2–3 working days, and you must pick up the hardware at the branch for physical training.

The 48-Hour Fast-Track Formula

To get approved in under 48 hours, follow this strict checklist:

- Pre-Verify your TIN: Use the TaxPro Max portal to ensure your status is “Active.”NIN Linkage: Ensure your BVN name matches your NIN name exactly.

- No Contract: Ensure you have terminated any old, dormant POS contracts.

Stay at the Shop: Be at your business location during the app submission to avoid GPS mismatch errors. - Speed is not luck. Speed is preparation. Once approved, you are no longer just a “user”—you are a registered agent in the formal Nigerian financial system

How Much You Really Need to Start a POS Business (2026 Cost Breakdown)

The “I can start with ₦20,000” era is officially over. Between the January 1, 2026, CAC enforcement and the rising cost of hardware, you now need a realistic budget to avoid getting shut down in your first month.

- The Mandatory Startup Costs (One-Time)

| Item | Estimated Cost (2026) | Why You Need It |

| CAC Business Registration | ₦21,000 – ₦35,000 | Mandatory fee for Business Name (₦21k) or LTD. |

| POS Terminal (Caution Fee) | ₦21,500 – ₦65,000 | Moniepoint is ~₦21,500; Android print terminals are higher. |

| Branded Kiosk/Booth | ₦45,000 – ₦100,000 | Roaming is banned. You need a fixed, secure structure. |

| Branding (Banner/Signage) | ₦5,000 – ₦15,000 | Visibility drives foot traffic to your location. |

| Security (Locks/Safe) | ₦5,000 – ₦12,000 | Protects your hardware and daily cash overnight. |

| Sub-Total (Setup) | ₦97,500 – ₦227,000 | Your real “entry fee” into the POS business. |

- The “Float” (Your Working Capital)

Your Float is the lifeblood of your POS business. It is the cash you keep in hand to give to customers. If you run out of cash at 11:00 AM, you are effectively closed for the day.

Minimum Recommended Float: ₦150,000.

Why: In 2026, average withdrawals are higher due to inflation. You must be able to handle at least 15–20 withdrawals of ₦5,000–₦10,000 before needing to recycle cash at the bank.

The Friday Rule: Double your float on Fridays and salary days to avoid turning away customers during peak demand.

- Monthly Running Expenses

These are the silent profit killers that eat into your ₦100 and ₦200 commissions:

- Data Subscription (4G/5G): ₦3,000 – ₦8,000 (Essential for uptime).

- Thermal Paper Rolls: ₦4,500 – ₦9,000 (A carton of 10–20 rolls).

- Space Rent (Ground Rent): ₦2,000 – ₦10,000 (Depending on location).

- Power (Charging/Solar): ₦2,500 (For high-capacity power banks or charging fees).

Total Capital required for a “Safe” Launch

To avoid failure in your first 30 days, we recommend a total starting capital of:

Total: ₦250,000 – ₦400,000 (Setup ₦100k+ | Float ₦150k+ | Buffer ₦50k+)

Wait… Can I Start with Less?

Yes—but only if you already have an existing shop and a valid CAC registration. In that case, you only need:

POS Terminal: ≈ ₦21,500

Initial Float: ≈ ₦100,000

For a brand-new standalone founder, ₦250k is the safety zone.

Summary: Invest for the Long Haul

Starting with the right capital keeps you alive long enough to build customer trust. As explained our detailed guide on Starting a Business in Nigeria, under-capitalization is the #1 reason Nigerian SMEs fail in their first year.

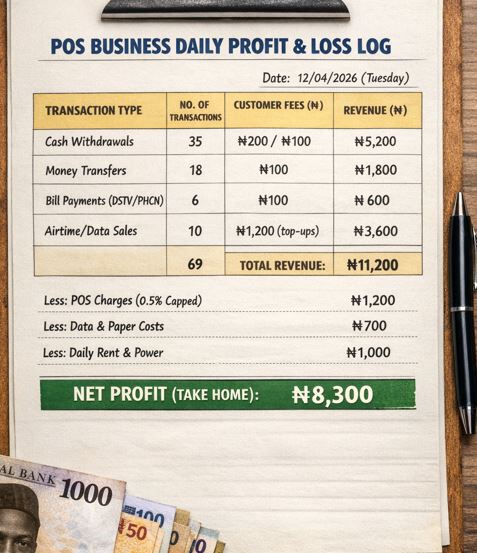

While individual commissions might seem small, the power of this business lies in daily repetition. Below are the real profit scenarios for a registered POS founder in the current Nigerian economy, reflecting the January 2026 tax and fee updates.

How Much a POS Business Makes Per Day (2026 Profit Scenarios)

In 2026, your “Gross Profit” is the total commission you collect, while your “Net Profit” is what you keep after paying your POS provider and covering daily costs. Tacking these numbers daily is the only way to ensure your business is actually growing and not just “moving cash.”

- The Average Transaction Math

Currently, pricing has shifted slightly due to the new 7.5% VAT on service fees and the ₦50 Electronic Money Transfer Levy (EMTL). Across most Nigerian hubs, these are the standard “Street Charges”:

- Withdrawals (up to ₦5,000): ₦100 – ₦200

- Withdrawals (₦5,001 – ₦10,000): ₦200 – ₦300

- Transfers / Deposits: ₦100 – ₦200 (Note: The ₦50 EMTL now applies to transfers of ₦10,000 and above).

- Bill Payments (DSTV, Electricity): ₦100 – ₦200 service charge.

The Provider’s Cut:

Most 2026 providers (Moniepoint, OPay, and Banks) charge 0.5% capped at ₦100 on withdrawals.

Example: On a ₦10,000 withdrawal where you charge the customer ₦200, the provider takes ₦50. After a tiny deduction for VAT on that fee, you keep approximately ₦146 profit.

- Real-World Daily Profit Scenarios

Scenario Daily Transactions Est. Gross Profit Net Daily Profit (After Costs)

- Slow Spot (Residential Area) 15 – 20 ₦2,500 – ₦4,500 ₦1,500 – ₦2,500

- Average Hub (Shop/Street) 40 – 60 ₦8,000 – ₦13,000 ₦5,500 – ₦9,000

- Goldmine (Market/Bus Park) 100+ ₦22,000+ ₦16,000+

Net profit accounts for data, paper rolls, and a portion of rent and security.

- Monthly Income Potential

- Low End: ₦45,000 – ₦75,000 (Ideal side hustle for existing shop owners).

- Mid-Range: ₦150,000 – ₦270,000 (A strong standalone small business).

- High End: ₦480,000+ (Usually requires multiple terminals or a prime market location).

- The “Value-Add” Strategy: Boosting Daily Earnings

Top 2026 founders don’t rely only on cash withdrawals; they act as “Mini-Banks”. They sell:

- Airtime & Data Sales: Earn 3% – 4% commission on every top-up.

- Utility Bills: Steady ₦100+ profit per transaction.

- Betting Top-ups: High-frequency transactions from loyal customers.

- Account Opening: Earn onboarding fees for helping customers open Tier-1 bank accounts at your kiosk.

Summary: Compliance Equals Longevity

Overcharging may give short-term gains, but market is governed by transparency, trust and volume win. By staying compliant with the pricing and registration rules, you build a POS business that is sustainable, traceable, and eligible for expansion loans.

How to Hire and Manage Your First POS Attendant

Once the profit starts rolling in, you’ll quickly realize you cannot sit at the kiosk 12 hours a day. Hiring an attendant is the first real step to scaling your POS business—but it is also where many founders lose everything through theft, poor service, and weak controls.

- The Ideal Candidate Profile

You don’t need a university graduate. You need someone with three non-negotiable traits:

- Basic Numeracy: They must calculate commissions and balance the daily float without errors.

- Integrity: They will handle physical cash. Honesty is not optional.

- Patience: POS customers experience failed and reversed transactions. Your attendant must explain issues calmly and professionally to maintain your business reputation.

- Security & Vetting (Don’t Skip This)

Before handing over your terminal and ₦150,000+ float, you must build a “legal wall” around your assets.

- Two Verifiable Guarantors: These should be parents, community leaders, or established shop owners. Physical verification of their addresses is mandatory.

- Documentation: Keep a clear copy of their NIN slip and a recent passport photograph.

- Clear Salary Structure: The best model is Base Salary + Performance Bonus.

Example: ₦30,000 base + ₦5 per transaction above a daily threshold (e.g., 30 transactions).

This model keeps them motivated to grow your volume rather than just “sitting” there.

- The “Daily Handover” Control System

This is what separates profitable founders from those who fold within months. You must treat every day as a fresh financial cycle.

- Morning: Hand over the float and record the exact amount in a physical or digital logbook.

- Evening: Generate the POS “End of Day” (EOD) report from the machine.

The Formula:

Initial Cash + Total Deposits − Total Withdrawals = Expected Cash in Hand

If the numbers don’t match the physical cash, the difference must be explained and settled immediately. Never let a “minor” shortage slide until the next day.

Summary: Systems Beat Trust

Trust your attendant—but verify with systems. In the modern agency banking system, the founders who expand to 5 or 10 locations are those who master this handover process early. Strong controls turn a one-man kiosk into a scalable, bankable business.

Training your attendant is the final and most important layer of your “business shield.” In the modern agency banking, fraud is no longer just about “bad luck”—it is an organized attempt to exploit gaps in human behavior and digital security.

If your attendant is not trained to spot these, a single 3-minute transaction can wipe out your entire week’s profit. Use this evergreen checklist as a mandatory training manual for anyone handling your terminal.

The POS Security & Anti-Fraud Checklist

Fraud tactics evolve, but they always rely on rushing or distracting the operator. By making these steps standard procedure, you protect your cash, your machine, and your reputation.

- The “Confirmation” Shield

- Ignore the Customer’s Screen: Never accept a transaction as successful just because the customer shows you a “Success” page on their phone. Screens can be faked, and apps can be cloned.

- The Terminal is the Boss: Only release cash when the POS terminal prints a “Successful” receipt or you see the credit alert in your official provider app.

Beware the “Refund” Scam: Fraudsters may send a fake “credit alert” SMS to your phone and then quickly claim they “overpaid” and ask for a cash refund. Always verify your actual balance first.

- Hardware & Card Security

- The “Amount Lock”: The attendant must enter the amount and verify it on the screen before handing the device to the customer. A common trick is for a customer to quickly press “cancel” or “clear” and change a ₦20,000 withdrawal to ₦2,000 while pretending to type their PIN.

- Hand-to-Hand Card Handling: Never let a customer take the terminal out of sight (e.g., inside a car). If they are using a card, the attendant should be the one to insert it into the machine.

- Daily Physical Inspection: Check your terminal every morning for “skimmers”—extra plastic parts or loose covers that don’t belong there. If the machine looks tampered with, do not use it.

- Protecting Your Digital Access

- The PIN Divide: Your attendant should have their own “Staff PIN” for basic transactions. They must never have your “Admin/Owner PIN,” which allows for sensitive actions like changing your settlement bank account.

- Zero-OTP Policy: Teach your attendant that no bank official will ever call to ask for an OTP (One-Time Password) or a PIN. If anyone calls claiming to be from “Support” and asks for a code to “upgrade” the machine, it is a scam.

- Operational Integrity

- No Phone Transfers: Discourage accepting transfers from a customer’s phone to your personal or business account. These are the easiest transactions for criminals to “reroute” or reverse hours later.

- The Evening Reconciliation: Every evening, the physical cash in the drawer must match the “Successful Transactions” total on the terminal’s End-of-Day (EOD) report. Any “Declined” receipt found in the cash drawer is a red flag for internal theft.

- Summary: Your Business, Protected

You have now completed the full blueprint for a sustainable POS business:

- Legal Foundation: You’ve secured your legal shield with CAC registration.

- Strategic Partner: You’ve chosen the right bank or fintech for your goals.

- Smart Location: You’ve settled in a “Financial Desert” within your geo-fenced zone.

- Operational Safety: You’ve hired right and implemented this anti-fraud checklist.

Helpful POS Business Resources:

- Where to get a POS machine in Nigeria

- Best Fintech POS Providers in Nigeria – Comparison Guide

- Download our POS Business Startup Checklist (2026 Updated) to make sure you’re not missing any critical step.